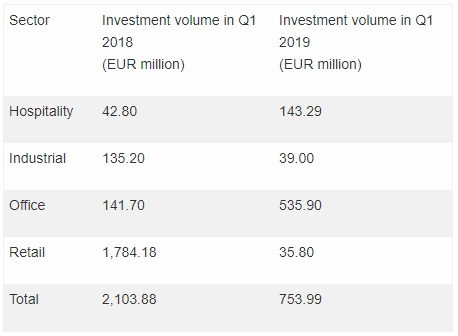

Global real estate services firm Cushman & Wakefield presents commercial real estate investment volumes. Approximately EUR 754m was invested in Polish commercial property in the first quarter of 2019.

- The office sector turned over EUR 536m, accounting for more than 70% of the transaction volume;

- Demand for retail assets slowed down in Q1 2019;

- 2019’s investment volume is expected to be on par with that recorded in 2018.

“The investment volume hit approximately EUR 754m in the first three months of 2019, of which over 70%, or EUR 536m, was invested in office assets. Although the first quarter’s result accounts for just a little more than one third of that recorded in the same period last year, the Polish market is likely to see an equally strong performance this year as in 2018 given pending transactions, the level of investment activity and asset availability,” says Marcin Kocerba, Associate, Capital Markets, Cushman & Wakefield.

According to global real estate services firm Cushman & Wakefield, office and hospitality assets attracted the strongest investor interest. Hospitality investment volume hit more than EUR 143m, which represented more than a threefold increase on the same period last year (approximately EUR 43m). The office sector saw an almost fourfold increase with nearly EUR 536m traded in Q1 2019 compared to approximately EUR 142m in Q1 2018. Retail attracted only EUR 36m in Q1 2019. The investment activity in the industrial sector reached EUR 39m in the first three months of 2019, down from approximately EUR 135.2m recorded in Q1 2018.

“Last year’s trends gained momentum in the first quarter of 2019 with high levels of investment activity on the office and industrial markets, and an increased interest in alternative assets such as hotels, PBSA and PRS. Investors are far more cautious about the retail sector with demand being highly selective,” says Marcin Kocerba.

Source: Cushman & Wakefield